Kenya Airways is among airlines that may not take delivery of ordered aircraft from American manufacturer Boeing following the expiry of an export financing scheme that was being run by the United States Export-Import (Exim) Bank.

The bank’s charter for operation expired in July, and the US Congress is divided on whether the financier’s mandate should be renewed. This means that Exim Bank cannot process applications or engage in new business, including the delivery of the last two of Kenya Airways’s Dreamliner jets.

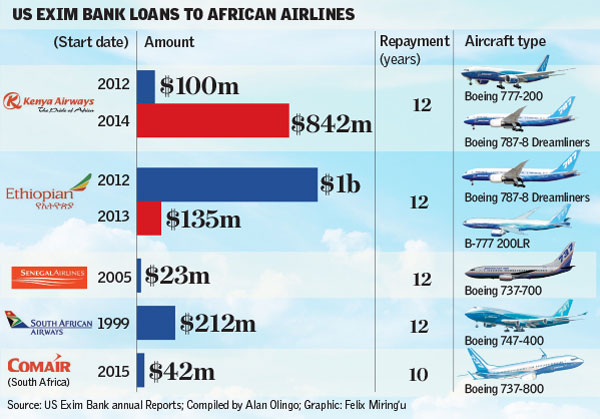

According to Exim Bank chairman Fred Hochberg, Kenya Airways was its largest client for 2014, with the bank having provided the airline with $835 million in finance guarantees to purchase six B787 Dreamliners; there is a 12-year repayment period for each aircraft.

The Africa Export Import Bank, which recently gave Kenya Airways $200 million to support operations, was part of the financing deal, including those for other Boeing aircraft.

READ: Loans may help Kenya Airways get two Dreamliners

Kenya Airways has sought other financiers in a bid to have the aircraft released and forestall penalties that could arise if it is unable to take delivery on schedule.

In May, Kenya Airways signed a financing agreement with Ireland’s AWAS Aviation Trading Ltd.

“Our airline has been pursuing an aggressive modernisation strategy. The new B787-8s have been instrumental in transforming our operations and we thank AWAS, who have proven to be a valuable, responsive and flexible business partner,†Kenya Airways chief executive officer Mbuvi Ngunze said.

According to Bloomberg, however, AWAS only financed one plane out of the three before dropping out of the deal, with Ireland’s Aviation Finance Ltd stepping in to provide direct financing to the airline.

“I can confirm we are working with Boeing, Kenya Airways and Afreximbank to find a better solution for the Kenyan airline,†Aviation Finance chief executive Douglas Brennan told Bloomberg.

Boeing, while declining to discuss the specifics of the aircraft’s costs or delivery timelines, said that it was working closely with Kenya Airways to meet its fleet needs.

Mr Ngunze declined to comment on the delivery of the two aircraft and the financing challenges.

“It is true there are some delays, but I cannot comment in terms of the specifics of the financing. Because of the financing arrangements, and given that we are a publicly listed company, we will only reveal those details when we have completed the arrangements,†Mr Ngunze said.

Ethiopian Airlines, which has financed much of its expansion through the US Exim Bank, divulged that the bank’s charter renewal was one of the country’s key pleas to President Barack Obama on his African tour of Kenya, Ethiopia and Ghana in July.

“We have worked with this bank for more than 40 years. We would like the bank to re-open and that was one of the discussion points with President Obama when he visited Ethiopia,†Tewolde Gebremariam, Ethiopian Airlines’s chief executive officer, said last week.

Recent Comments